MAXIMIZE YOUR REAL ESTATE TAX SAVINGS

There’s so much to consider when embarking on a new construction project. One factor that should always be taken into account is the opportunity for tax savings. There are many favorable tax strategies that can boost a project’s bottom line, and often the key to employing them most successfully is simply good planning. Cost segregation is one of these powerful strategies, and it is primarily used to accelerate depreciation deductions, though it has myriad applications. The benefits of cost segregation on new construction and renovation projects are significant tax deferrals and improved cash flow.

How Does It Work?

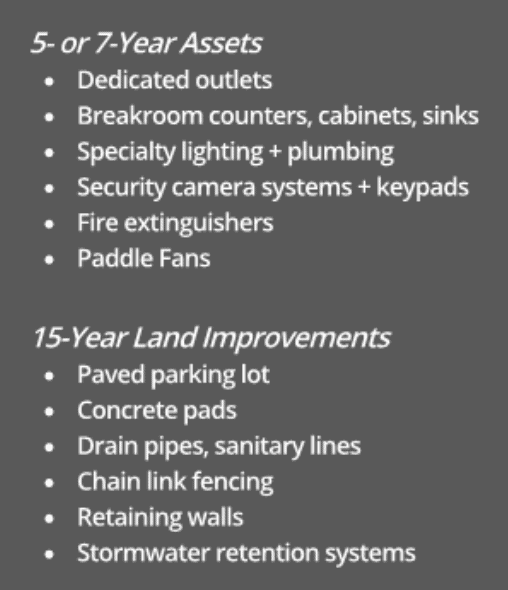

Cost segregation is an IRS-recognized tax benefit strategy in which specific components of a building or improvement project are identified and reallocated into modified accelerated cost recovery system (MACRS) class lives for federal tax purposes. Treating the assets as personal property or land improvements allows depreciation of these assets to be accelerated. Personal property depreciates over 5 or 7 years and land improvements depreciate over 15 years. This is significantly quicker than the conventional 39-year depreciation period. The taxpayer is not creating new deductions but is shifting the deductions towards the earlier years of ownership. This front-loading of depreciation offsets income and lowers the tax burden. This accelerated depreciation can create $30,000 to $200,000 in federal tax benefits for every $1,000,000 invested into a property.

Cost segregation is an IRS-recognized tax benefit strategy in which specific components of a building or improvement project are identified and reallocated into modified accelerated cost recovery system (MACRS) class lives for federal tax purposes. Treating the assets as personal property or land improvements allows depreciation of these assets to be accelerated. Personal property depreciates over 5 or 7 years and land improvements depreciate over 15 years. This is significantly quicker than the conventional 39-year depreciation period. The taxpayer is not creating new deductions but is shifting the deductions towards the earlier years of ownership. This front-loading of depreciation offsets income and lowers the tax burden. This accelerated depreciation can create $30,000 to $200,000 in federal tax benefits for every $1,000,000 invested into a property.

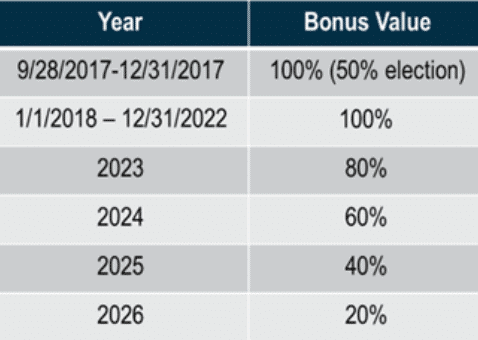

Accelerating depreciation is just the beginning of tax savings that can be achieved through cost segregation. There is an additional benefit called “bonus depreciation.” Recent tax reform permits the immediate write-off of the full purchase price of eligible assets in addition to other depreciation. New and used assets with class lives of 20 years or less are eligible for this “bonus” which significantly boosts tax savings. Cost segregation is the primary vehicle used to determine and document which assets have eligible class lives and are therefore eligible for this powerful incentive. The table on the right lists the established bonus depreciation rates through 2026. The rate for eligible assets placed-in-service through 2022 is 100%, followed by a subsequent decline.

Accelerating depreciation is just the beginning of tax savings that can be achieved through cost segregation. There is an additional benefit called “bonus depreciation.” Recent tax reform permits the immediate write-off of the full purchase price of eligible assets in addition to other depreciation. New and used assets with class lives of 20 years or less are eligible for this “bonus” which significantly boosts tax savings. Cost segregation is the primary vehicle used to determine and document which assets have eligible class lives and are therefore eligible for this powerful incentive. The table on the right lists the established bonus depreciation rates through 2026. The rate for eligible assets placed-in-service through 2022 is 100%, followed by a subsequent decline.

What is Eligible for Cost Segregation? What Kind of Assets Can Be Assigned Shorter Class Lives?

Eligible structures include buildings and facilities placed-in-service after December 31, 1986 and/or renovations and additions completed after December 31, 1986.

Ideally, it’s best to perform a cost segregation study immediately after a property is placed-in-service, to maximize savings from day one. However, if that was not possible, the IRS allows for recapture of the benefits from previous years using a “look-back” cost segregation study. By reclassifying assets to their correct lives, entities can “catch-up” on all the depreciation they would have realized had the study been performed on day one.

Many building components can be moved into shorter class lives, thus undergoing accelerated depreciation and becoming eligible for bonus depreciation. A list of some commonly segregated assets are shown in the sidebar to the right.

How Can I Make the Most of Cost Segregation?

Three words – plan, plan, plan. Thinking ahead is the key to leveraging all possible opportunities. Be sure to let your accountant know that you’re planning to buy, build, or renovate. They will be able to help you maximize all relevant tax strategies. There are steps you can take to improve the outcomes even before construction begins. For example, if you’re building from the ground up, try to select materials that are eligible for rapid depreciation when possible. For example, ceramic floor tile depreciates slowly over 39 years. However, resilient tile flooring has a short 5-year class life.

Three words – plan, plan, plan. Thinking ahead is the key to leveraging all possible opportunities. Be sure to let your accountant know that you’re planning to buy, build, or renovate. They will be able to help you maximize all relevant tax strategies. There are steps you can take to improve the outcomes even before construction begins. For example, if you’re building from the ground up, try to select materials that are eligible for rapid depreciation when possible. For example, ceramic floor tile depreciates slowly over 39 years. However, resilient tile flooring has a short 5-year class life.

Another planning point relates to EPAct 179D, a one-time deduction benefit that permits the accelerated depreciation of a newly constructed or renovated energy-efficient property that meets a certain standard. If you are constructing or renovating property, consider incorporating energy-efficient improvements in lighting, HVAC, or building envelope as you might be eligible for a depreciation deduction of up to $1.80/improved square foot.

If you will be disposing of assets, you should plan for that too. If an asset no longer exists, the remaining depreciable basis of that asset may be written off in the year the asset was removed. This is called Partial Asset Disposition. You need to plan ahead and perform a cost segregation study to provide the data supporting this write-off.

Example

A newly constructed light industrial facility was placed-in-service in 2019, consisting of a single-story manufacturing and distribution facility. The eastern side of the building is utilized as product storage while the western side includes the product printing areas, process drying ovens, and administrative office space. The depreciable basis of this property was $11,846,221.

The owners wanted to maximize 100% bonus depreciation from day one, so a cost segregation study was commissioned. Engineers were able to move 7.9% of assets (not including equipment purchased for the facility outside of the construction contract) into 7-year personal property, and 18.2% of assets into 15-year land improvements, resulting in an additional first year tax savings of $1,062,988 (using a blended tax rate of 34.6%).

How Do I Get Started?

A quality cost segregation study is the key to maximizing your tax savings, as it provides the precise and comprehensive data required to support a suite of tax strategies. Recent legislation has continued to broaden the utility and scope of the traditional cost segregation study, and there has truly never been a better time to explore this opportunity. Capstan Tax Strategies provides free Estimates of Benefits for potential cost segregation studies. Capstan can take a look at your property and give you a realistic idea of what benefits you can expect. This information is useful during the pro forma phase as well. Let’s talk about what Capstan, and cost segregation, can do for you on your next construction project.

Terri S. Johnson, CRE, is a co-founder and partner at Capstan Tax Strategies. Terri works closely with commercial real estate owners and accounting firms to provide practical, creative, and customized engineering-based tax solutions. Visit www.capstantax.com to learn more or contact Terri at tjohnson@capstantax.com or (215) 885-7510.